In March 2023, discretionary U.S. general merchandise retail sales revenue fell 7%, compared to March 2022, and unit sales fell 8%, which is double the average monthly declines in January and February. These steeper sales declines remained consistent during the last three weeks of March, spanning both units and dollars for the first time this year, according to Circana, the new market intelligence firm formed by the fusion of IRI and The NPD Group.

“Consumers are beginning to spend less on both discretionary and essential purchases with more consistency,” said Marshal Cohen, chief retail industry advisor for Circana. “In order to create some spending elevation, there needs to be new products and new ways of thinking to reflect the changed consumer behavior and retail landscape.”

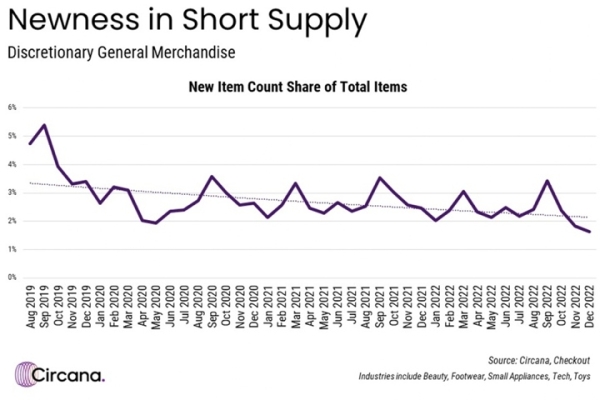

Simultaneously, Circana notes that product innovation has reached a historical low. “Before the pandemic, new general merchandise products represented more than 5% of the market. By the end of 2022, that number was less than 2%,” underlined the market research firm.

Indeed, investment in new product development was put on hold due to uncertainties caused by the pandemic and most companies adjusted priorities to fulfill demand while addressing supply chain issues, and then focused on selling excess inventory.

“One of the biggest retail casualties of the pandemic has been the availability of new and refreshed products for consumers, and now economic uncertainty is putting even more pressure on the consumer’s interest in spending,” said Cohen, “Manufacturers and retailers need to broadcast their value and prove their worth to the consumer now, in order to avoid a downward spiral later.”

According to Circana, the trends in consumer spending and new product deficits in the marketplace have directional similarities that are intensified by elevated prices. Compounding these consumer distractions are news stories about inflation and bank insolvencies that continue to raise consumer concerns about the economy, which can adversely affect consumer sentiment and spending.